Why Semiconductors Matter in the Age of AI

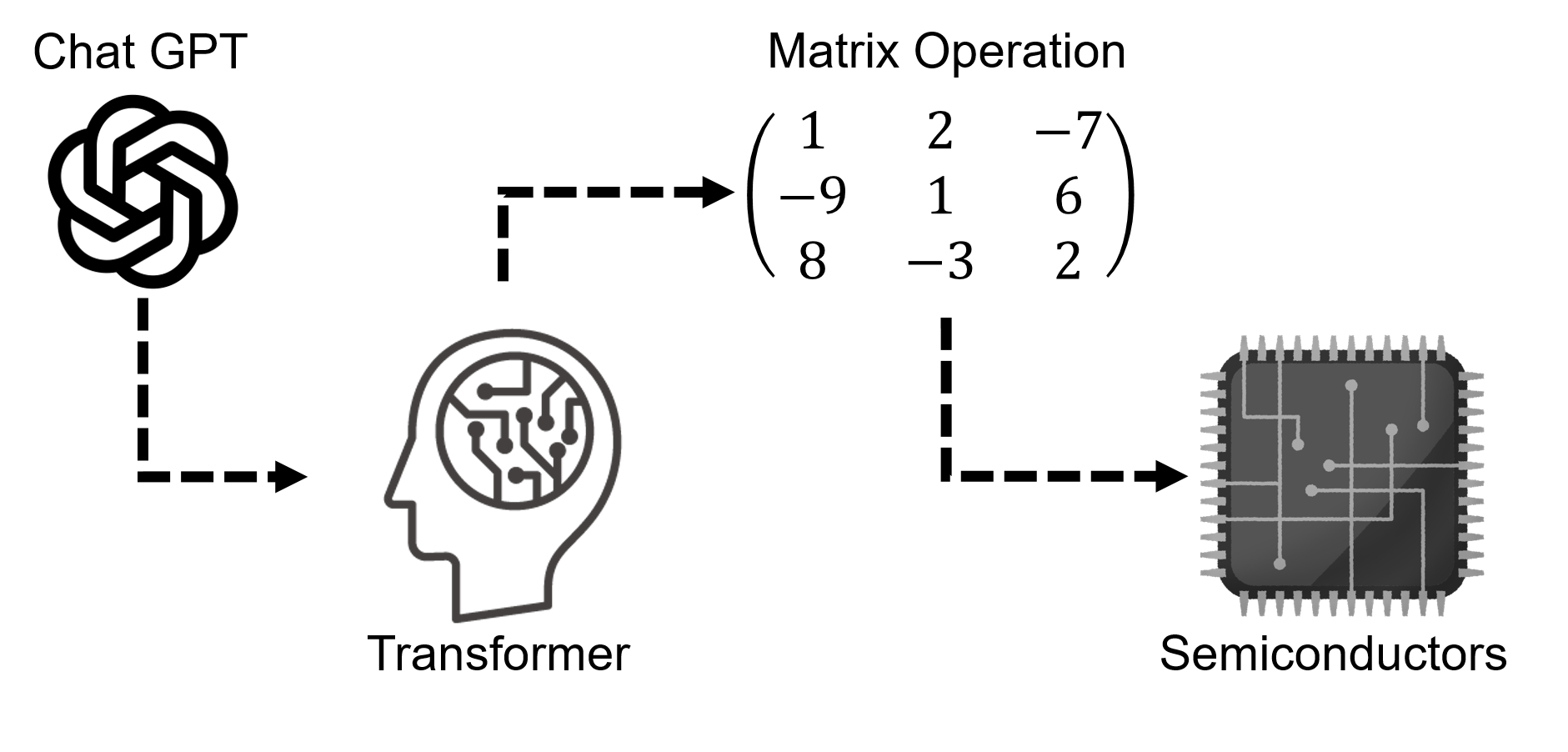

Modern AI technologies—especially deep learning—require the ability to process massive amounts of data quickly and efficiently. This processing power is enabled by high-performance semiconductors such as GPUs (Graphics Processing Units). For instance, services like ChatGPT or image-generating AI can respond in real time thanks to thousands or even tens of thousands of semiconductor chips operating in parallel behind the scenes.

Semiconductors as the “Brain” of AI: The Engine Behind Computation

AI doesn’t “think” like humans. Instead, it performs complex matrix calculations to conduct what we call “learning” and “inference.” These operations require chips optimized for parallel processing, such as GPUs or TPUs (Tensor Processing Units)—all of which are types of semiconductors. These specialized chips are crucial to enabling the core functions of modern AI.

From Commercial Use to Military Applications: AI as a Strategic Technology

Semiconductors are not just tools for computation. They serve as the core of AI-powered systems such as autonomous vehicles, facial recognition software, and even strategic military technologies. Because of their critical role in such applications, semiconductors have become “strategic assets,” deeply intertwined with national security and international diplomacy.

A Chain Reaction of Growth: Advancing AI → Rising Demand for Semiconductors

As AI capabilities advance, so too does the need for greater computational power. This leads to surging demand for ever-more sophisticated semiconductor technology. Companies like NVIDIA have experienced explosive growth fueled by the AI boom, pushing their market capitalization to the top ranks of the global tech industry.

Major Powers’ Semiconductor Strategies: The U.S., China, and Taiwan

United States: Rebuilding Domestic Manufacturing Through the CHIPS Act

For years, the U.S. has led the world in semiconductor design with companies like NVIDIA, Intel, and AMD, but it has largely outsourced manufacturing to countries such as Taiwan and South Korea. To address this imbalance, the U.S. passed the CHIPS and Science Act in 2022, aiming to revitalize its domestic semiconductor industry.

Key initiatives include:

- Over $52.7 billion in federal subsidies to support semiconductor manufacturing

- Tax incentives to stimulate private sector investment

- A partnership with TSMC, which is building a $12 billion chip fabrication plant in Arizona

Even NVIDIA CEO Jensen Huang has expressed concern over the rapid progress of Chinese AI chip technologies, warning that the U.S.-China race for AI dominance is tightening.

China: Pushing for Self-Reliance and Responding to Export Restrictions

In response to U.S. export controls on advanced semiconductors, China is accelerating its domestic innovation through companies like Huawei and SMIC (Semiconductor Manufacturing International Corporation).

Notable strategies include:

- Strengthening domestic chip production under the “Made in China 2025” industrial policy

- Development of Huawei’s Ascend series of AI chips

- A national goal to localize 70% of the semiconductor supply chain by 2028

China is particularly focused on AI inference chips, aiming to deploy them in data centers, surveillance systems, and other strategic infrastructures using homegrown technologies.

Taiwan: TSMC at the Forefront of Semiconductor Technology

Taiwan Semiconductor Manufacturing Company (TSMC) is the world’s most advanced chipmaker, producing over 90% of the global supply of leading-edge semiconductors (3nm/5nm). As U.S.-China tensions escalate, Taiwan finds itself at the strategic center of the tech rivalry.

Key developments:

- TSMC is building a facility in Arizona, strengthening ties with the U.S.

- Expansion into Japan through a new plant in Kumamoto, in partnership with Sony

- Limited technology exports to China, reflecting geopolitical caution

Comparison Table: U.S., China, and Taiwan (TSMC)

| Category | United States | China | Taiwan (TSMC) |

|---|---|---|---|

| Policy | CHIPS Act, financial support | State-led self-sufficiency initiatives | Private-sector driven, global expansion |

| Strength | Chip design (NVIDIA, Intel, etc.) | Market size, national investment | Cutting-edge manufacturing, mass production |

| Challenges | Hollowed-out domestic manufacturing | Dependence on foreign manufacturing equipment | Geopolitical vulnerability, supply chain fragility |

Geopolitical Risks and the Reshaping of the Semiconductor Supply Chain

Pandemic Exposed the Fragility of Global Supply Chains

The global outbreak of COVID-19 after 2020 caused a severe semiconductor shortage, affecting industries across the board—automobiles, smartphones, home electronics, and more. This crisis made countries acutely aware of the dangers of over-reliance on globalized supply chains.

One major concern was the concentration of advanced semiconductor manufacturing in a few regions, particularly Taiwan and South Korea.

The Taiwan Risk: A Geopolitical Flashpoint

Taiwan, home to TSMC’s most advanced manufacturing lines, is at the heart of tensions with China. A potential conflict in the Taiwan Strait could bring the global production of AI chips and smartphones to a standstill, with devastating effects on the world economy.

To mitigate this risk, countries like the United States and Japan are working to reduce dependency on Taiwan by attracting TSMC to build domestic facilities and pursuing regional diversification of the supply chain.

“Friendshoring” as a New Supply Chain Strategy

In response to both geopolitical tensions and the pandemic, nations are turning to a strategy known as “friendshoring”—building supply chains among politically stable and allied countries. Key developments include:

- United States: Reshoring manufacturing with Intel and TSMC Arizona

- Japan: Reviving domestic chip production through Rapidus and TSMC Kumamoto

- EU: Strengthening manufacturing via the European Chips Act

- India & Southeast Asia: Emerging as new manufacturing hubs

This shift marks a strategic move away from efficiency-focused globalization toward resilience-focused regional partnerships.

Looking Ahead: Technological Competition and the Potential for Global Collaboration

The Next Battleground: Emerging Technologies

As AI continues to advance, so too must semiconductor technology. The next technological battleground includes:

- Sub-2nm manufacturing processes: Fierce competition among TSMC, Intel, and Samsung

- AI-specific chips (ASICs): Including Google’s TPU, Meta’s MTIA, and Tesla’s Dojo

- Breakthrough innovations: Quantum computing and photonic semiconductors

These areas will define the future of both national security and corporate competitiveness, further intensifying the U.S.-China tech rivalry.

Fragmentation Risks: The World Divided by Technology

The deepening divide between the U.S. and China is leading to technological fragmentation, or “tech bloc-ification.” For example:

- The U.S.-led Chip 4 alliance (Japan, U.S., South Korea, Taiwan)

- China’s independent ecosystem, including RISC-V and domestic EDA tools

If fully divided technology spheres emerge, we risk losing global standards and slowing down international innovation and collaboration.

Signs of International Cooperation

Despite rising tensions, some areas show promise for global cooperation, especially in supply chain resilience and environmental sustainability:

- Rapidus, a U.S.-Japan joint venture in advanced chip production

- TSMC’s multi-country expansion (United States, Japan, Germany)

- EU-led collaborative research and standardization frameworks

Striking the right balance between competition and cooperation will be crucial in shaping the future of AI and the global semiconductor landscape.

Leave a Reply